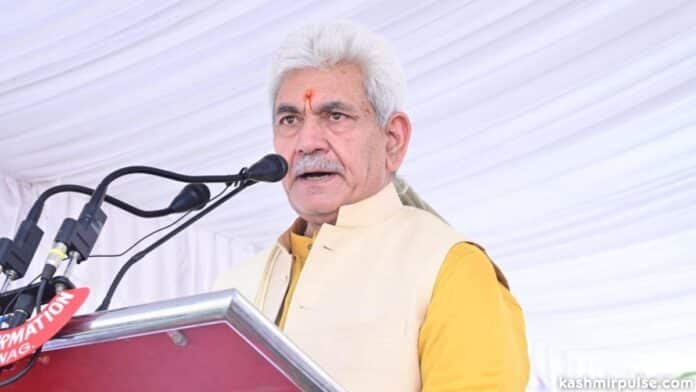

SRINAGAR — Jammu and Kashmir Lieutenant Governor Manoj Sinha said that 40 percent of J&K’s urban population will have to pay no property tax and the remaining 60 percent have to pay a nominal amount between Rs 600 to Rs 1000 maximum amount per annum. He said that the tax amount fixed is one-tenth of the tax being paid by Shimla, Ambala, and Dehradun.

Talking to reporters on the sidelines of a function at SKICC here, the LG as per news agency KNO, said in J&K, 2,0,3,680 households are less than 1500 sq. feet.

“Forty percent of people living within the limits of Municipal Corporations/Committees won’t have to pay the tax. Eighty percent of the 2,0,3,680 households will have to pay a nominal amount of Rs 600 only while the rest will have to pay a nominal amount of Rs 1000 as property tax per annum. This amount is one-tenth of the tax amount being paid by Shimla, Ambala and Dehradun,” LG Sinha said.

About the commercial property including shops, the LG said that 1,01,000 shops are in J&K of which 42 percent of shops are less than 100 sq. feet. “These shops will have to pay less than Rs 700 per annum. 76 percent of the total shops of 1,01,000 shops will have to pay a very minimum amount as the property tax,” he said, adding that the amount collected will directly go into the accounts of Municipal Corporations and be utilized for the development of the areas where tax will be collected.

“I urge the common people of J&K to come forward and help build a better J&K,” the LG said. On Saturday, the LG stated that property tax will be imposed after thorough consultations with the general public.

Pertinently, the J&K Government announced the imposition of property tax in the UT from April 1. The move evoked sharp criticism from the cross-section of society and the political parties, who demanded immediate rollback of the order.

The Housing and Urban Development Department of Jammu and Kashmir announced to impose property tax in Municipal areas under the Jammu and Kashmir Property Tax (Other Municipalities) Rules, 2023. The rules prescribe certain rules for the levy, assessment, and collection of property tax in the municipalities and municipal councils of the Union Territory of Jammu and Kashmir, effective from April 1, 2023.

The government notified the rule in the exercise of the power conferred by Section 71A of the Jammu and Kashmir Municipal Act 2000. In October 2020, the Ministry of Home Affairs (MHA) empowered the Jammu and Kashmir administration to impose the property tax after an amendment to the J&K Municipal Act, 2000, and J&K Municipal Corporation Act, 2000 through the J&K Reorganisation (Adaption of State Laws) Order, 2020.

Follow Us

The Kashmir Pulse is now on Google News. Subscribe our Telegram channel and Follow our WhatsApp channel for timely news updates!